Concierge Retirement Services

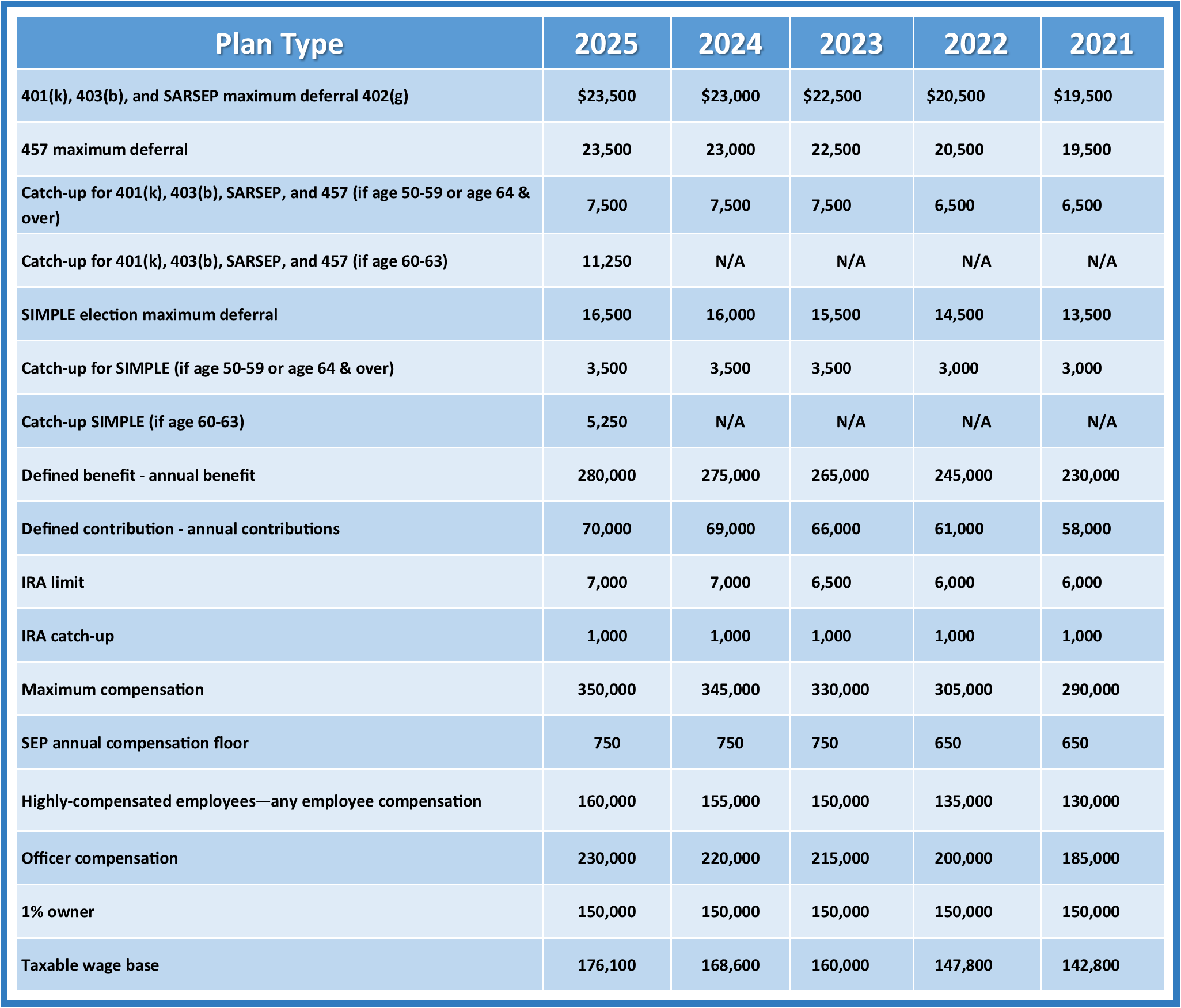

Caps and Maximum Contribution Numbers

Concierge Retirement Services team of dedicated Concierge Retirement Plan Consultant have provided the following table as a handy reference.

We are committed to helping you achieve your objectives and goals.

Invested in People

For more information, please don’t hesitate to reach out and contact us today.

A contact form is below.

Let’s Build Something Together

Would you like to have a conversation? Would you like to discover more?

Here’s a few ways to get in touch with us.

Info@ConciergeRetirementServices.com

7 Rye Ridge Plaza #404

Rye Brook, NY 10573

+1 (914) 251-0099

Follow Us